In 2025, a high school graduate can take an estimated $ 40,000 in student loans before finishing college education, and interest rates on undergraduate federal student loans are the highest in more than 10 years, Ned Walt Reported.

The price tag with a college degree has been permanently in the balloon for the past several decades – in the last 15 years there has been a surprising increase.

Between 2000 and 2022, average tuition and fees increased by 60 %, from 9,204 to $ 14,688 per year, and between 2010 and 2022, these costs increased by 13 % in just 12 years. Best Cleans.

Related: These are the largest college with the lowest rates of college – and philosophy is more than computer science

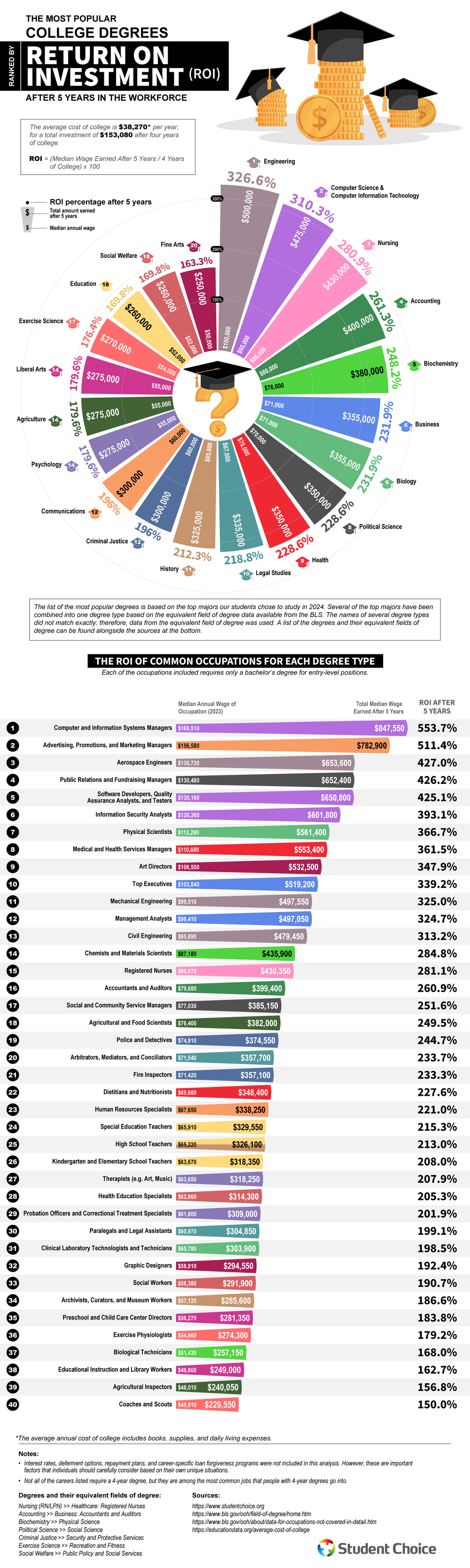

Today’s college graduates can expect to spend 3 153,080 by the end of their undergraduate education. Choosing studentsAn organization that contributes to more than 300 300 credit unions for ease of resolving students’ loans.

But which college Majers – and the careers they make for new graduates – provide the most return to students’ investment?

The selection of students examined the Bureau of Labor Statistics data to identify the middle income for the most famous College Majers in the United States, the analysis spent five years in the workforce and the average annual cost of the college.

Related: Goldman Sex CIO says coders want to take classes of philosophy. Why

According to the report, engineering came up as a degree with the highest five -year return on investment at 326.6 %, and computer science/technology came in second place at 310.3 %.

Computer and information system managers and advertising, promotions and marketing managers snatched high places for career with the highest five -year return on 553.7 % and 511.4 %, respectively, 553.7 %, respectively.

Related: According to a new report, it is more likely to expire 3 professions in the next 20 years due to AI.

Take a look at the Student Choice Infographic below for the full picture of Majers and career -related reports related to the highest profit on investment for college education cost:

Image Credit: Courtesy of Courtesy Students

In 2025, a high school graduate can take an estimated $ 40,000 in student loans before finishing college education, and interest rates on undergraduate federal student loans are the highest in more than 10 years, Ned Walt Reported.

The price tag with a college degree has been permanently in the balloon for the past several decades – in the last 15 years there has been a surprising increase.

Between 2000 and 2022, average tuition and fees increased by 60 %, from 9,204 to $ 14,688 per year, and between 2010 and 2022, these costs increased by 13 % in just 12 years. Best Cleans.

The rest of this article is locked.

Join the business+ To reach today.