In the world of online marketing, an analysis of a keyword difference is mostly associated with SEO, where a company will compare the keywords that their website is ranked to identify any sector against their rivals’ keywords for which it is not for it. The purpose is that their rivals are performing well for them and are developing strategies for them.

In addition to the word “ranking” and assuming that it is translated into “performance”, there is nothing to say that this process may not apply to paid media campaigns. Or that your rivals are just key words that your rivals are bidding. They are valuable.

In this article, I would like to talk about how we can use (mostly free) tools for the discovery of keywords for payment campaigns and discuss why you want to do so.

Content

Why do you analyze key words differences for PPC?

Whether you are trying to find new key words through your search terms or see where competitors are bidding, a great way to make sure that your paid search accounts are living and ready. The difficulties are that the initial keyword research is still applicable when you started your campaigns. But over time, things change.

Google keeps emphasizing that 15 % of the questions are new every day, their system has never been seen before.

Whether you take advantage of your search terms to see how the questions are ready or if you are working your competitors, analysis of this kind of difference can ensure that you are moving with your customer base and will not stagnate while everyone leaves you behind.

👀 👀 Want to look at how your Google advertisements are doing? Try our Free Google Advertising Performance Grader for Quick Audit!

How to analyze key words differences to improve PPC campaigns: step -by -step

Follow the steps you can use to improve your search campaigns.

1. Review your current keyword

We will reach your rivals in a minute, but in the first place I always encourage advertisers to find new keywords in their search terms.

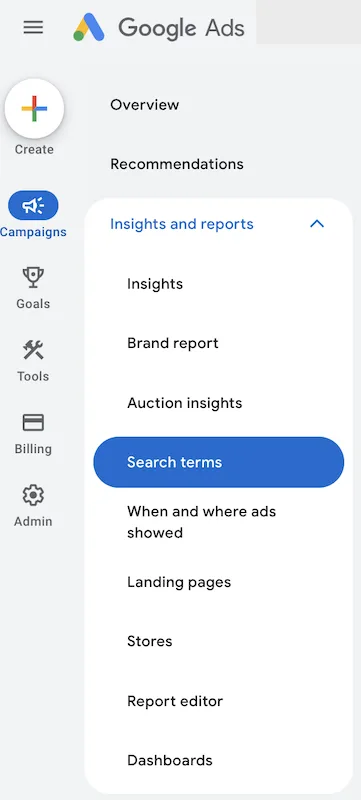

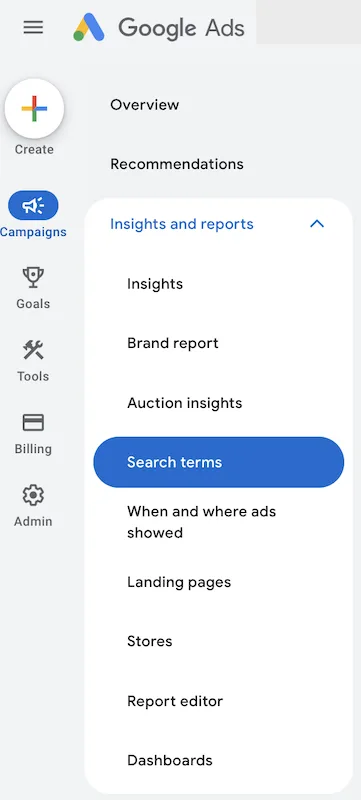

In Google Advertising, it is under the section of the insights and reports of the interface, and all the terms here are questions for which you are already shown.

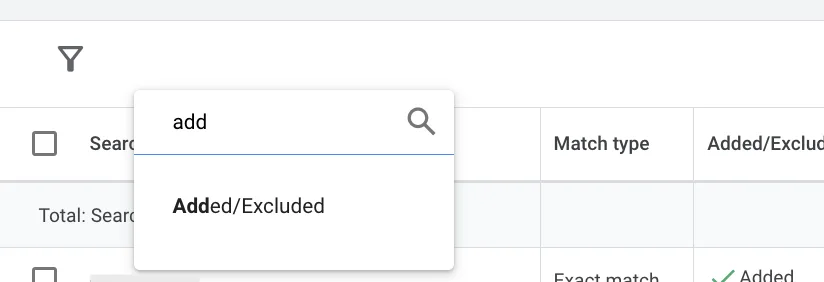

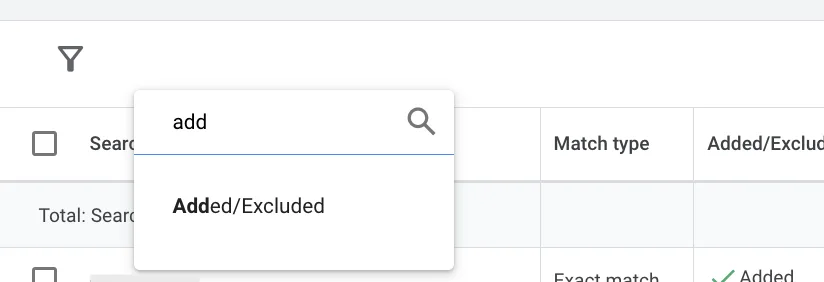

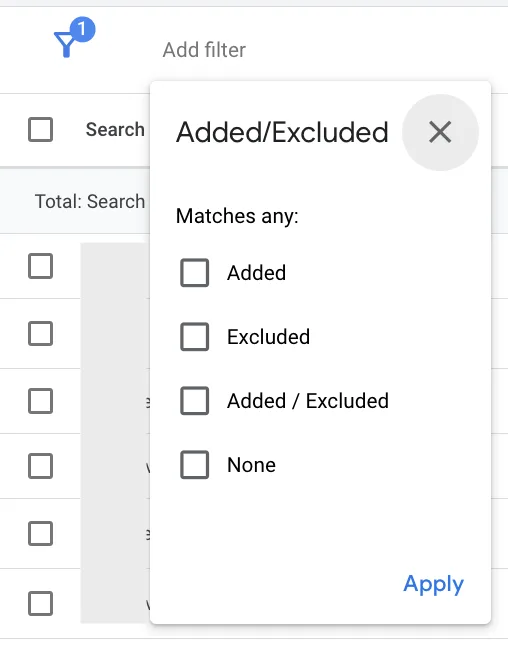

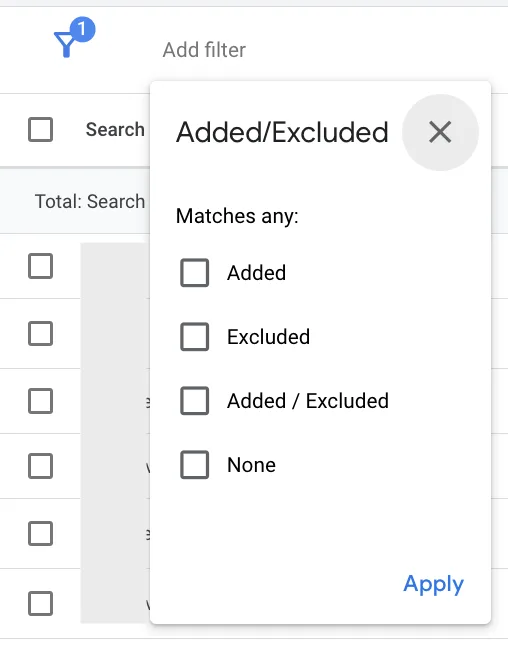

Once you get there, there is a simple filter that will help you find only new terms in your account. Either go to the dropdown or find “Add” in the filters as I did in the picture above, and select the add/deleted option from the dropdown.

From there, check the box with someone. This will only show you the search terms showing your ads that you have not already included as key words or that has not been included as a negative keyword.

The advantage of this is that you are finding new forms of relevant terms that your users are actively looking for. They are probably a good fit of your business (assuming that you regularly review the negative keywords), and they are guaranteed that you have the volume of searching because you are already seeing it in your account.

Additionally, although Google always recommends getting rid of the terms that are “duplicates”, though they are not the same, they still reward the advertisement to match the account in accordance with the account. It is placed in their preferred documents. If an inquiry is like a keyword in your account and the other is near, but not the same, then the exact version will have more advertisement status and it will have a better chance of matching.

🔎 🔎 Need to help find the right keywords for your campaigns? Try our free keyword device!

2. Collect your competitors

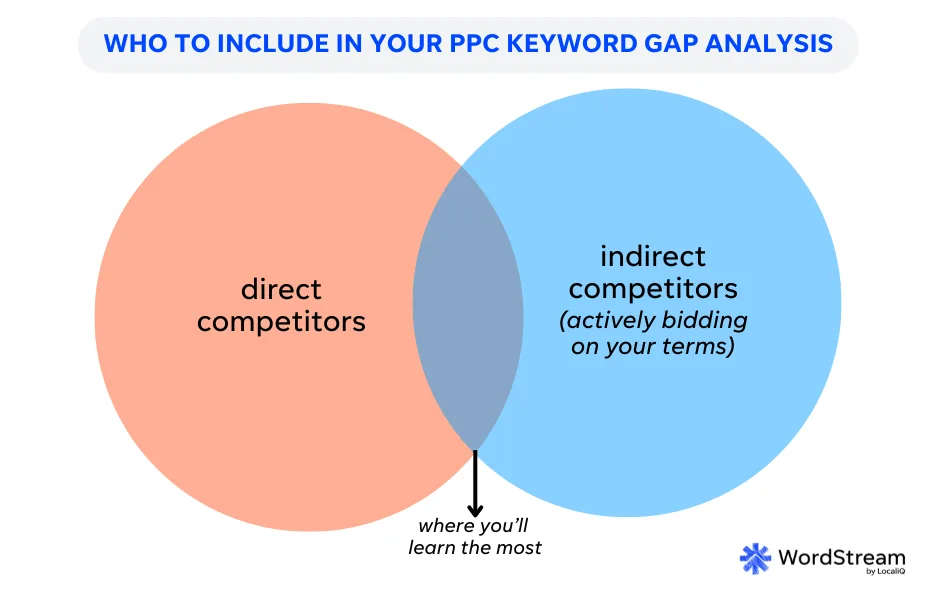

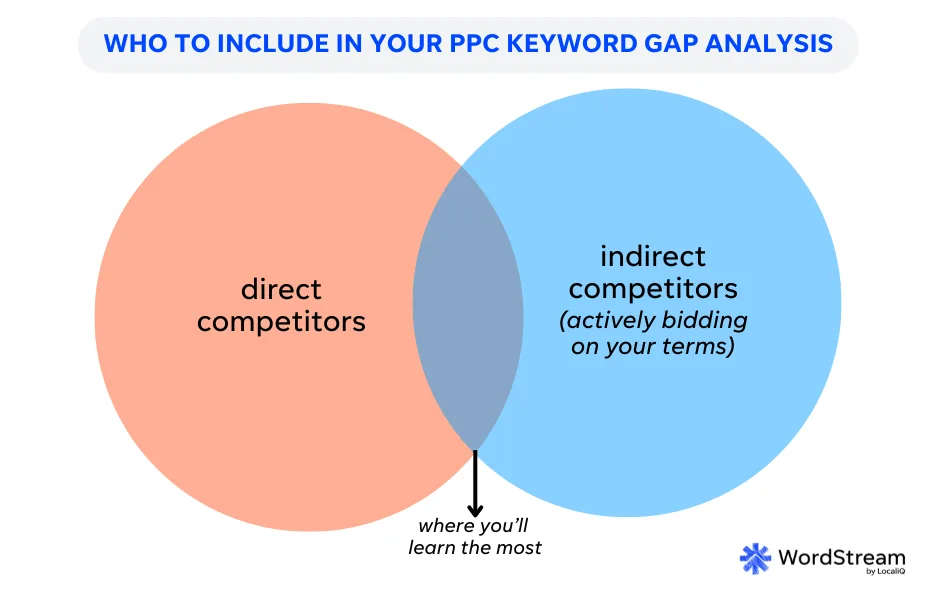

This is the first step of the process Get a list of competitors You want to use for space review. There are two different rivals that I want to think about this exercise.

- Traditional rivals: These are the companies that work for you, and you potentially compete for the same users directly. Think on a small scale like Duncan and Star Boxes, such as large brands, or a roofing company.

- Active advertisers: These are the companies that are bidding on your keywords. Find a simple with your current keywords and see who comes. These are the people you are literally competing in search, even if you do not do what you do.

The reason for the use of both of us groups is due to the above mentioned irritation. There are some companies that are direct rivals and they are not taking bids against you, others who are not really rivals but are bidding against you, and the group from which we will learn the most is the cross section of both of them: those who are your rivals and are bidding on your terms.

🕵 🕵 Want a keen look at what your competitors are doing? Free Guide >> How to spy on your competitors: 7 ways to become a competitive Supervisor

3. Scan the websites

Now that we have a list of competitors, we are going to use their websites for some light light.

We are going to use Google Advertising key words planners and select the “Start with a Website” option and input each site with competitors.

The results listed will show all the key words thinking about the website in Google. It can give you all kinds of ideas based on the contents of your rival site.

Best Part: There is a column on the right that will show you if you already have any keywords in your account. This is a very fast way to review a key word for you for compatibility and then easily check whether you are already using it or if this is a new term you can test.

Sometimes, a company’s entire website can be a little wider. If you are getting a lot of irrelevant terms but you are sure that the company is related to your business, try using individual pages from the site instead of the entire site. If possible, occupy a few pages of their landing and run them through a tool so that you can see what you can take.

A PPC Key Word Gap Analysis Example

Although Google Advertising keyword planners can be a great tool to identify new terms and easily compare their accounts, I am really a great fan of functionality in some paid research tools there. Is one of my favorite SpyphoBut others have a similar functionality.

Through Spypho, you can take all your competitors (directly or indirectly), put their websites in the device, and see all kinds of information about their paid search campaigns.

Here are some data points you can see:

- Search terms shown for their ads

- Average Advertising Budget

- Number of active keywords

Quality before going more: This is all estimated data. Spofo cannot really know what the key words of the competitor are or how much they spend. They can only see the search terms that an advertisement has shown for the number of active keywords and ads budgets and shows them for reverse engineer.

Although this data is not perfect, there are still many things we can learn from it. So if you can accept the warning that you need, keep reading.

Still here?

Great!

Let’s start with an example website, Loose.com. (Yes, I’m planning to improve home, so Lu is in mind.

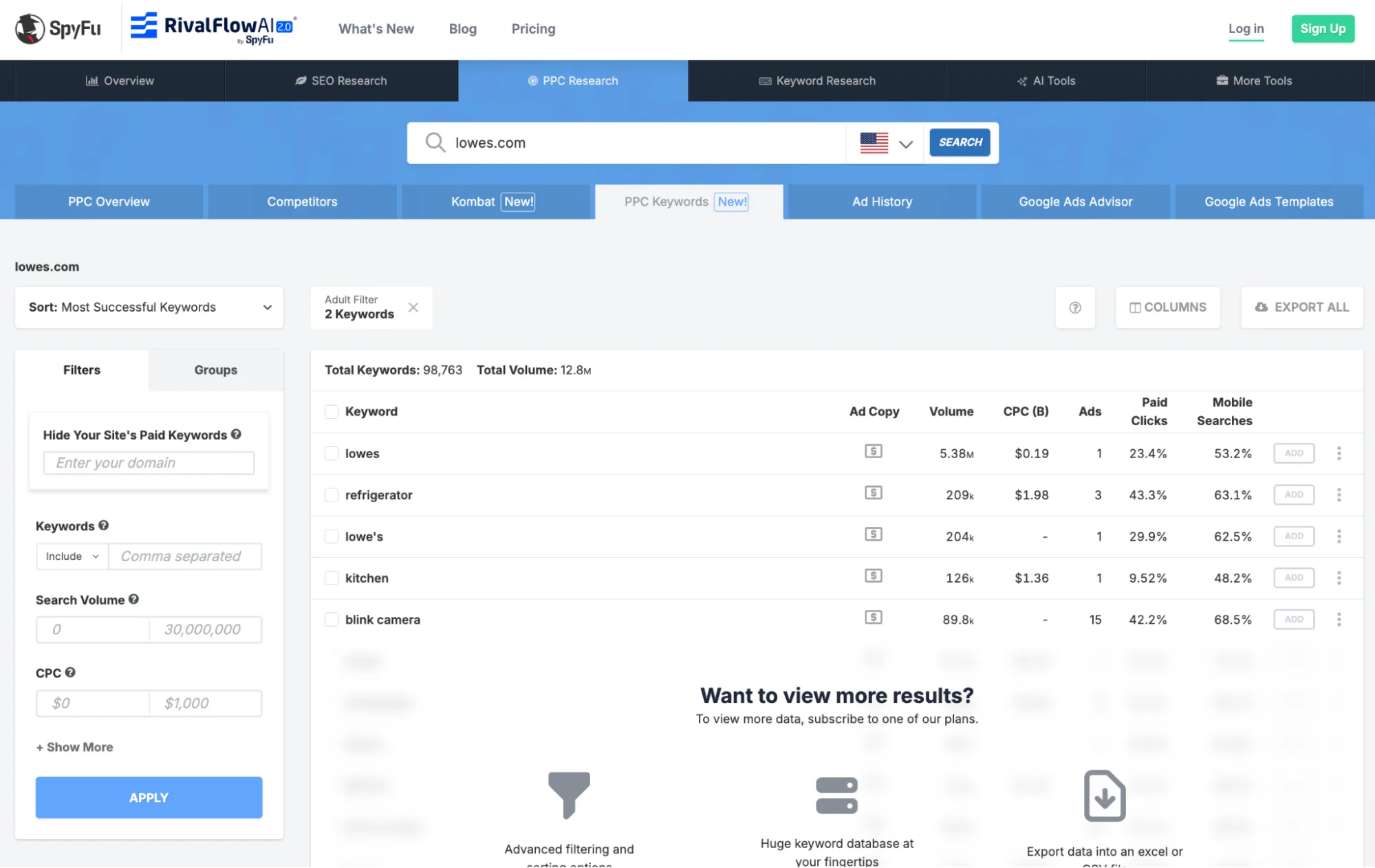

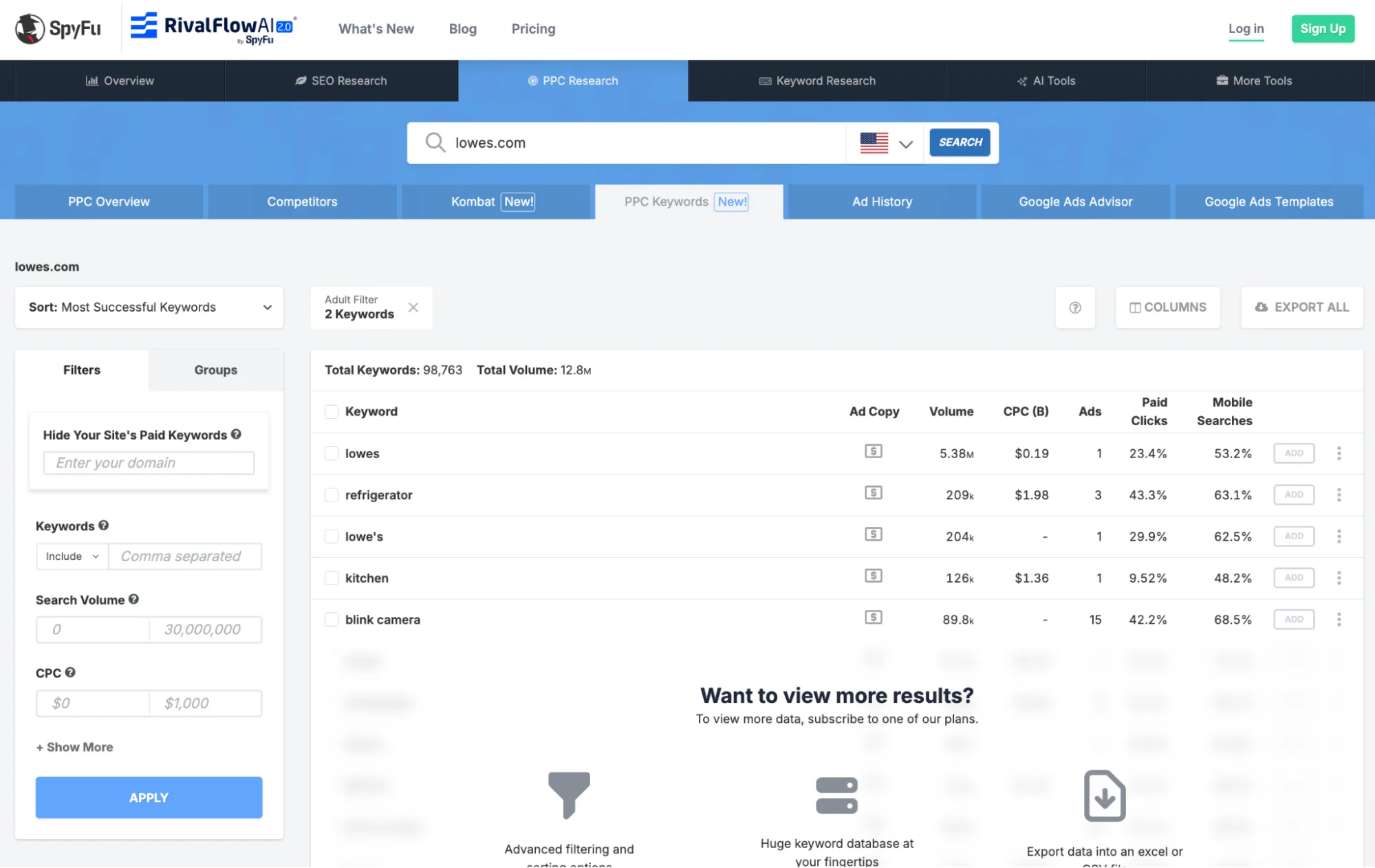

If we input Love.com in Spufu, then go to the PPC Research Section, then choose PPC keywords, we will see a report that looks like this. It has highlighted the PPC’s high -performing high -performing, with LOWS Loose being shown.

As you can see, this report has been smaller than just five terms because we are in a free account, but if you pay for Spypho, you see many different situations here.

Each of these terms can be a valuable keyword to target you if you are a rival and want to show in the same surplus that they are. A similar process can be done for all your rivals to find the higher terms for which they are shown and try to take some new topics for themselves.

He said, “My favorite report in Spypho is Combat.” On this tab, you can input many rivals, then see how their search term coverage is overlap in the van diagram.

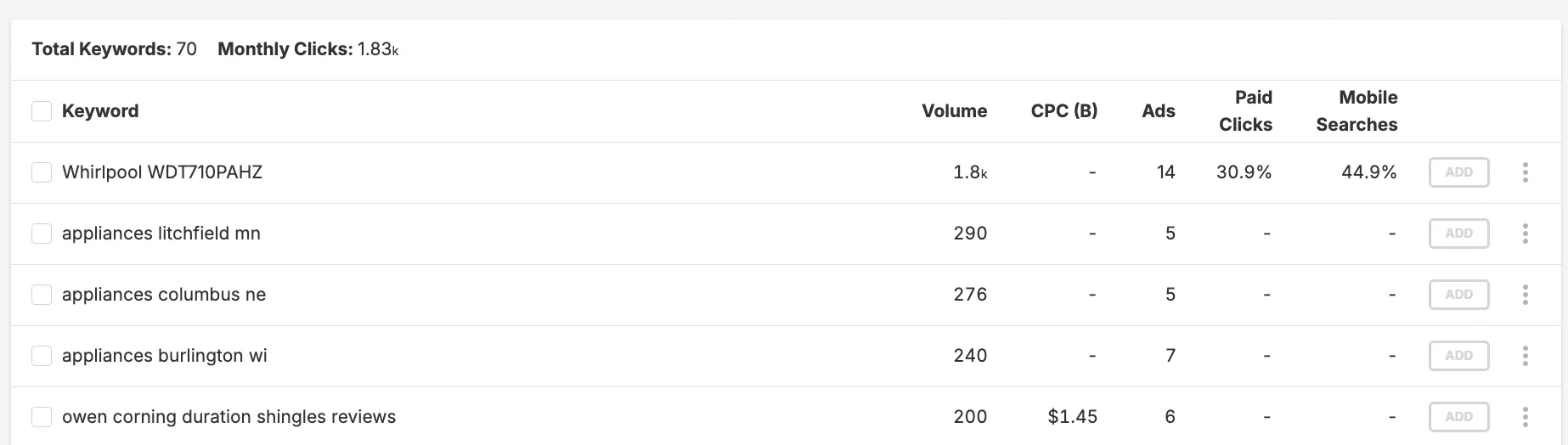

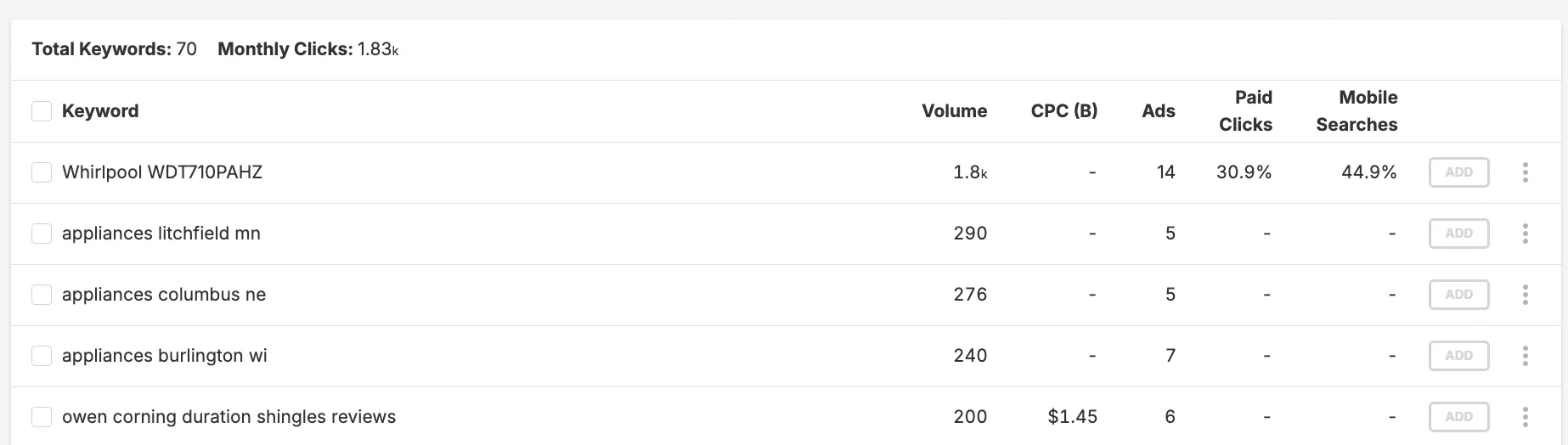

Here, you can see the search term coverage of the home depot and the miners against Lou. Here is a group of 118 “basic keywords”, which means that all three brands are bidding on these terms.

But jewelry comes from seeing what the home depot or the minarets do not have. In particular, the “buy buy” section, in this example, with 70 keywords, the search terms show that home depot and mandates are showing that it is not the loo.

In this example, two rivals are showing for the aforementioned terms, while Lu has been released. If you are a paid search manager for Lu and you know that you offer the oven corning period shugs, this may be a good term for you to see.

In addition, three of the five terms listed are for “appliances”, in addition to a city, state location. It may be a complete keyword theme that Lu should review research and construction to ensure that they have coverage for people in search of appliances in areas where they have stores.

Once again, these are the only questions that are being shown for home depot and municipalities, not specific keywords, but they are on something with the terms of both location, and it seems that the market is being left out of the conversation. Perhaps at least a good place to investigate and see if it should be included in the search for their payment.

Find new opportunities with PPC Key Word Gap Analysis

Analyzing a keyword difference can help you identify new fields of search campaigns on the basis of what your competitors are doing. By following these simple steps, you can discover opportunities to increase your keyword lists and improve your campaigns. Need help with your Google Advertising? Reach the demo to find out how we can help.